-

Service

Best Not to Take Those Relationships for Granted...

September 2020

When it comes to thinking about the new normal, even before COVID-19, banks and credit unions were already ahead of the curve. We've been dealing with shifts in the balance between in-person and digital banking strategies for some time. Given the extra dependence on digital during the pandemic, it makes sense that everyone is talking about the importance of customer experience, both in regard to ease of digital platforms and direct human exchange. There are too many choices for engaged customers to bother sticking around for bad experiences.

We think a great customer experience comes from the relationship established between account holders and their institutions. We now understand that often what constitutes a great relationship depends on some responsiveness and knowledge of a client's life stage. As an example, we were interested to see a recent blog post by Strategis, a communications and marketing firm, talking about the particulars of engaging Millennials and Gen Z clients. Many young folks are already well versed in digital platforms and communications and are likely transitioning to pandemic protocols for various transactions fairly well. However, it is imperative not to underestimate the need for personal contact right now, perhaps more than ever. As Strategis points out, many younger people may be experiencing uncertainties in their financial situations particular to their generation… anything from having just graduated into an unexpectedly shrunken job market to having student and/or first car loan payments while under-employed. Awareness and sensitivity in dealing with the particular needs (and anxieties) of your account holders will go a long way to creating lasting and trusting relationships.

Sometimes a quick solution to a simple need is all that's called for. When someone is clear about what they need, fill the need, thank them and let them go. Sometimes, however, it's not about a simple transaction. Sometimes, they're looking for advice, additional information, help in getting a loan, etc. A great experience comes from someone taking an interest, feeling understood, and moving forward accordingly.

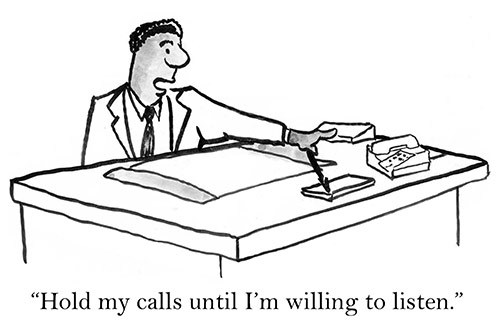

This is where we separate the product pushers from the consultants. Beyond being an expert in your institution's products and services, you also need to be an expert in relationship management. Attempting to sell the flavor of the day to everyone you speak to is like throwing mud at a wall. Maybe some of it will stick and someone will buy. Do you really want to spend your time trying to talk someone into something they don't need? Focusing on what the account holder or prospect needs, rather than what the institution wants to sell, produces the great experience your customers want and the loyalty you need.

In today's somewhat crazy environment, a common refrain seems to be: "I don't know who to trust." Don't make them wonder about you.

"I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel."

- Maya Angelou -

Recent Articles

- Stop Wasting Time: Train Only on What You Don't Know

- AI for course creation? Let the trainer beware!

- Lessons from TD Bank

- Up Your FAQ — Part II

- Up Your FAQ (Financial Advisor Quotient)